Today, a new report was released that analyzes the historical issues of traditional (fiat) currencies and why 16 countries now face annual inflation of more than 20 percent. The report reveals how these conditions have led to the rise in cryptocurrency projects aimed at developing stable digital money (stablecoins), and works to separate the hype from the reality when it comes to the role stablecoins will play in combating the impact of inflation on the people living in these countries. The “State of Stablecoins 2019: Hype vs. Reality in the Race for Stable, Global, Digital Money” report is based on data collected from 40 cryptocurrency and stablecoin companies, and was prepared by George Samman, a third-party blockchain and cryptocurrency industry veteran.

“This report clearly illustrates why the world needs a stable, digital currency that gives people autonomy and control of their money globally,” said Nevin Freeman, CEO of Reserve. “Cryptocurrencies like Bitcoin emerged with the goal of fulfilling this global need — but the high volatility of today’s cryptocurrencies hinders their usefulness. Today, people in emerging economies need a way to protect their money, a way send money to/receive money from their families in other countries, and merchants need a stable means of exchange in which to do business. The stablecoin market is focused on fulfilling those needs, and this report provides great depth on the various approaches companies in this market are taking to bring these solutions to the people.”

“One of the challenges in progressing digital money has been the difficulty to distinguish between hype and fact. This report makes great strides in that regard, delivering a factual and objective consideration of stablecoins,” said Jonas Karlberg, CEO of blockchain advisory AmaZix. “It makes an invaluable resource and starting point for understanding the hype driving stablecoins’ necessity as a possible bridge between cryptocurrency and traditional money — while grounding that comprehension in sound research and relevant case study.”

“Like it or not, StableCoins are now most definitely a thing,” said Fran Strajnar, Founder and CEO, Brave New Coin. “This report does a great job of detailing who is minting what and how. It will be a competitive space to watch and inevitably we expect to see state-issued cryptographic currencies to evolve out of this trend.”

The independent report, presented by a consortium of companies in the cryptocurrency and stablecoin markets including Reserve, Arrington XRP Capital, Blocktower, AmaZix, and Brave New Coin (BNC), reached the following conclusions regarding the global movement toward stable, digital money:

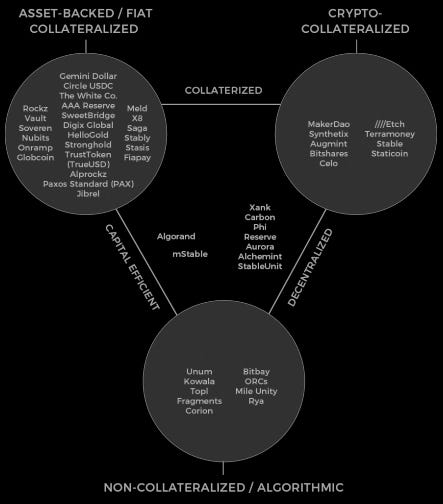

- The rise of cryptocurrency as a new asset class has brought about a new paradigm for financial systems — one where money is no longer issued and created solely by governments.

- The development of price-stable digital currencies (stablecoins) is playing a critical role in how this new decentralized economic era functions.

- Developed nations with “stable” fiat currencies will not be early adopters of these new stable digital currencies — instead, developing nations with high inflation will drive the rapid adoption of stablecoins.

- While stability is currently assumed to be tethered to the USD, in the future it is expected that the stability of stablecoins will be tied to a diversified basket of tokenized assets rather than the USD.

- The holy grail of stablecoins is to become the decentralized central bank for the internet. Only with true decentralization can the needs of people in emerging markets — especially those living under authoritarian regimes — be met without fear of these stable currencies being shut down.

And while the current hype around stablecoins is high, the stablecoin industry is not without its challenges. This report delves into potential design issues that could hinder USD-pegged stablecoins, the need for stablecoins to move beyond a USD peg in order to become truly censorship resistant, the risk of big companies like Facebook potentially entering the market with their own stablecoins, and more.

“The stablecoin market has made significant strides in the past year, but there is still much work to be done,” said Freeman. “What’s needed is greater coordination amongst projects, and greater focus on the application of stablecoins to solving real-world problems in the places where they are needed the most.”

The full report can be downloaded here, and for additional comment, please contact Robb Henshaw at robb.henshaw@reserve.org.

By AmaZix Editorial on February 20, 2019.

Exported from Medium on January 30, 2020.