Is a Security Token Offering (STO) a truly viable alternative to an Initial Coin Offering?

The answer to that question depends a lot on the nature of your project, your goals, where you intend to register your offering, and what you really mean by ‘alternative’. Where ICOs may have once embodied the maverick spirit of cryptocurrency, offering fundraising freedom and a bold new frontier for entrepreneurship, proponents of STOs view digital securities as the only path to redemption for an industry littered with the corpses of failed projects.

This report heralds the first in a series examining the STO landscape on a jurisdiction-by-jurisdiction basis. In each guide, we’ll outline the path towards conducting a compliant security token offering in key global regions and chart concomitant regulatory progress regarding digital securities. Whether you’re deadset on conducting an STO or are simply curious to learn whether STO is the new ICO, you’ll find all the answers you need, starting with our inaugural report which is focused on the USA.

It all starts with the SEC

In any discussion about securities regulation, the logical place to begin is in the United States, where the U.S. Securities and Exchange Commission (SEC) plays gatekeeper to the domestic market and by extension is the unofficial, but perhaps not that unofficial, world finance police. For if cryptocurrency is our new frontier, the SEC is the sheriff come to town, meting out its own punitive brand of justice.

Among the many projects that have already felt the long arm of the law are Munchee, which was shut down after its utility token was deemed a security in December 2017, as well as Paragon Coin and Airfox which each received a $250,000 fine in November 2018. Even as early as July 2017, the SEC’s DAO report declared that a German ICO with German founders fell under its jurisdiction since U.S. citizens could purchase the tokens on secondary trading platforms. In this climate, the eagerness of U.S. startups to engage with the regulatory body from the outset is perfectly understandable.

Exemptions

In the U.S., any security must either be registered with the SEC or qualify for an exemption, and since the costs of registration can run into the hundreds of thousands of dollars, an exemption is usually the favored choice. That is not to say an SEC exemption is an easy route to conducting an STO; it just happens to be easier than the alternative.

The main exemptions are as follows:

Reg D

At the moment, most of the security token offerings that sought an exemption have done so under the Reg D filing, with two such high-profile examples being tZero and StartEngine.

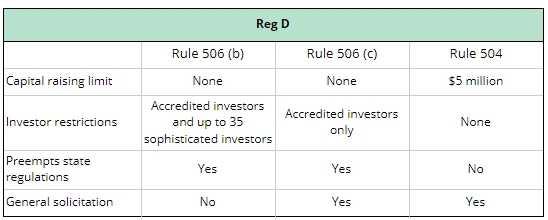

There are a number of different rules a security can file under Reg D. Rule 506 (b), Rule 506 © and Rule 504. The latter does not preempt state regulations, meaning that it must also comply with regulations in each individual state it sells securities. For this reason we will concentrate on 506 (b) and © which preempt state regulations nationwide.

Accredited investors

There are a number of routes to becoming an accredited investor as defined by the SEC. The lowest barrier to entry is to have a net worth of $1 million or over, with your primary residence not included as an asset. Alternatively, if you can prove you have had a yearly income of $200,000 for the past two years or a joint income with your spouse of $300,000, you can achieve accredited status. Organizations such as banks or non-profits can also be classed as accredited. In any case, with the median national income of the U.S. currently holding at $61,372, accredited status is off-limits to most citizens.

Sophisticated investors

A sophisticated investor is a non-accredited investor who nevertheless has enough wealth and business acumen to shield them financially from short-term losses and to properly evaluate the risks and rewards of an investment decision. Although “sophisticated investor” may sound like a less exacting term than accredited investor, the barriers for qualification are still at a high level.

General solicitation

As described by the SEC, general solicitation includes adverts on any kind of media such as newspapers, magazines, websites, radio, television and seminars for the purposes of raising funds. Crucially, the SEC adds that “The use of an unrestricted, and therefore publicly available, website constitutes general solicitation.”

Transferring Reg D securities

Securities purchased during a Reg D exemption remain under restrictions and can only be sold to accredited investors. Both parties and the company will have to undertake the correct paperwork to effect a transfer.

Reg D summary

With an unlimited raise and fast approval speed, Rule 506 (b) and © are appealing options for those seeking funds from institutional and accredited investors. However, those same restrictions may appear antithetical to the disruptive, democratizing vision which plays a part of so many blockchain projects.

Reg A+

This exemption has often been referred to as the “ mini Initial Public Offering “ and allows for non-accredited investors to participate. However, it is believed at the time of writing that no Reg A+ STO has yet been passed by the SEC. On April 12, 2019, however, Blockstack filed for a $50m Reg A+ STO, with many tipping it to be the first blockchain project to gain the go-ahead from the SEC.

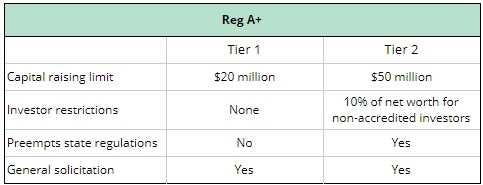

There are two main types of Reg A+ exemption, Tier 1 and Tier 2. In both cases, one of the initial filing requirements is that two years of financial statements are submitted for the scrutiny of the SEC. Reg A+ is therefore tailored to startups that have already established their businesses prior to making their offering public. A Tier 1 offering is also subject to state review as it does not preempt state regulations. Although Tier 2 offerings do include investor restrictions, it is the responsibility of investors to self-certify their net worth.

Disclosure requirements

Unlike the other exemptions we have discussed, a Reg A+ Tier 2 exemption requires the issuer to make annual disclosures for as long as their shareholders number 300 or over after the first year. This includes a semi-annual report, current reports, and ongoing audited financials.

Transferring Reg A+ securities

Since Reg A+ securities can be purchased by non-accredited investors, they are much easier to transfer than Reg D securities.

Reg A+ summary

There are a number of things which make Reg A+ STOs appealing, but the headline feature is that non-accredited investors can participate. At this time, however, the drawbacks are numerous. Reg A+ exemptions are far slower to process than Reg D, more expensive, incur disclosure requirements (Tier 2), and as yet remain unproven with not a single successful example to list.

Reg CF

Regulation CF or regulation crowdfunding is designed to allow startups to quickly raise up to $1.07 million in funds. It allows general solicitation and preempts state regulations. However, a Reg CF must be conducted through a registered platform only, and there remains a 12-month lock-up on securities after purchase.

Reg S

Regulation S is a safe harbor exemption for securities sold to non-U.S. investors and can be used in combination with other exemptions.

Case Study: StartEngine

The funding portal StartEngine provides great insight into the U.S. regulatory market. The company not only acts as a portal for other companies wishing to raise funds via Reg CF, Reg D © and Reg A+, but has itself conducted several security offerings.

The company filed for its first Reg A+ — non-crypto security — back in September 2017, and was qualified by the SEC in just three months. In June 2018 the company decided to repeat the feat, this time by conducting another Reg A+ for a cryptocurrency token. Then, in November 2018, and without qualification from the SEC, StartEngine changed tack and instead decided to hold a “limited time” Reg D STO which would close as soon as the Reg A+ filing was qualified. To date, the Reg A+ STO has still to be approved.

An alternative?

Due to regulatory concerns, conducting an ICO in the US is an extremely risky affair. Blockchain projects based in the states are therefore wise to look at the possibility of conducting a security token offering, with exemptions the best option available. Reg A+ has arguably gathered the most excitement since it is perceived to most closely resemble an ICO, but in practice no Reg A+ STO has yet been conducted.

At present, the only practicable options for conducting an STO on US soil with US investors are Reg CF for small raises, or Reg D for institutional investors only.

NEXT TIME: Managing an STO in Europe including Liechtenstein, Malta, Gibraltar, Germany, Switzerland and the UK.

The present blog post cannot and does not contain legal, fiscal or business advice. These legal information are only for guidance on matters of interest and for general informational and educational purposes. Therefore, the present blog post should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers and we encourage you to consult with the appropriate legal professionals, licensed attorneys, tax and business advisors in order to examine the actual facts involved. All information in this blog post is provided “as is”, with no guarantee of completeness, accuracy, timeliness. In no event will AmaZix be held responsible for any party’s use of the information contained in or linked from this blog post or for any decision made or action taken in reliance on the information in this blog post.

Originally published at https://www.amazix.com.

By AmaZix Editorial on April 25, 2019.

Exported from Medium on January 30, 2020.