In the first of our series of STO articles, we set out to discover whether conducting an STO in the USA was a viable option at this point in time. We investigated America’s challenging regulatory framework and the enforcement policies of the SEC. We also examined the various registration exemptions available to US firms and discovered that what may at first look appealing on paper isn’t always workable in practice. In short, there are options available to US companies, but no easy answers.

Now, in our sophomore examination of STO jurisdictions, we’ll be focusing on Europe and the EU, encountering a far more welcoming climate for the blockchain industry. Yet despite Europe’s more accessible markets and greater regulatory latitude, the very nature of the EU as a collection of nation states presents its own set of issues. Here we examine the intricacies of conducting an STO in different EU and non-EU states, finding great similarities between them, but with just enough differences to warrant cautious consideration.

The EU and the ESMA

In the EU, the body responsible for securities regulation, the European Securities and Markets Authority (ESMA), has issued guidance for investors and businesses. In 2017 the ESMA labeled ICOs as “high risk” investments, but stated that “depending on how they are structured, may fall outside of the regulated space”. In particular, payment and utility tokens may not be deemed securities by the ESMA, or by the relevant EU member state. This “hands off” ruling from the organization should also be considered a warning to investors: if the ESMA elects not to regulate utility token sales, there are no safeguards and you’re entirely on your own.

The ESMA also states that companies “must give careful consideration as to whether their activities constitute regulated activities “ or they will face the possibility of legal action. Further, “where the coins or tokens qualify as financial instruments it is likely that the firms involved in ICOs conduct regulated investment activities, such as placing, dealing in or advising on financial instruments or managing or marketing collective investment schemes”.

It is up to the governing bodies of individual member states to rule on what constitutes a financial instrument and a regulated activity, but any company involved in a security token offering should operate from the starting assumption that their token offering falls into this category.

For STOs, the relevant pieces of ESMA legislation are as follows:

The Prospectus Directive

This directive demands that adequate information is provided to investors prior to the sale of securities anywhere in the EU. All necessary information required for an investor to make an informed decision will be provided by the company, including business information, financials and shareholding structure, with the prospectus subject to the approval of the relevant national financial authority.

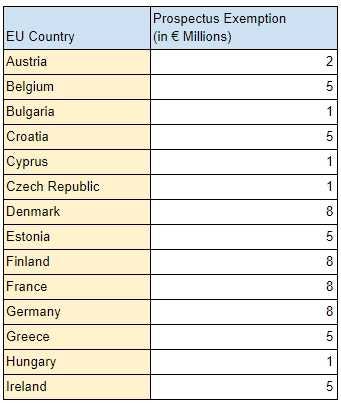

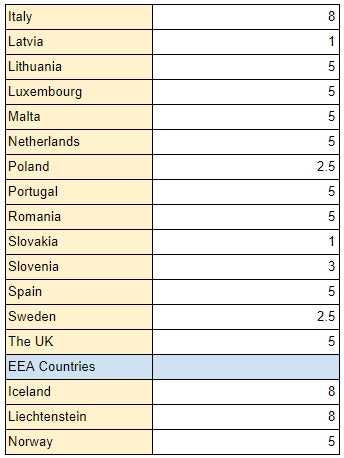

Member states may exempt the need for a prospectus up to the value of €5 million, with this ceiling being raised to €8 million by July 2019. This exemption figure is decided by the individual nation state so it will not and does not always match the maximum allowance.

Further prospectus exemptions can be obtained where the funding is only to be sought from “qualified investors”, or where the minimum investment required from each investor is €50,000 or more. In the case of this exemption type, the securities cannot then be freely traded to retail investors.

The Markets in Financial Instruments Directive (MiFID)

MiFiD is designed to create a single market for investment services across the EU and European Economic Area (EEA). This includes regular reporting requirements and transparency in trading standards.

The Alternative Investment Fund Managers Directive (AIFMD)

Depending on how an offering is structured, it may also need to comply with AIFMD rules. AIFMD deals with capital and operational structures as well as transparency.

The Fifth Anti-Money Laundering Directive

This piece of legislation deals with due diligence and attempts to prevent illicit money sources from entering into the EU. In practical terms, this legislation relates to KYC/AML standards set out by the ESMA.

A company must work within the above regulatory framework as well as any laws particular to the country they are operating in. Importantly, the prospectus will be adjudicated on by the financial regulator in the state in which the STO is being held. So while there are similarities between countries in the EU and Europe, there is still room for interpretation and a certain amount of latitude.

This legislation applies to:

EU and EEA members: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom.

EFTA and EEA members: Iceland, Liechtenstein and Norway.

The EU also recognizes Turkish regulatory standards as broadly in line with Europe.

Liechtenstein

Although Liechtenstein is not an EU country it does comply with the EU prospectus directive. In fact, the first European STO in compliance with ESMA requirements was conducted in Liechtenstein by the Nash exchange platform, after the company made significant inroads with Lichtenstein’s Financial Market Authority (FMA) in October 2018. Once the FMA accepted the Nash Exchange submission that blockchain could form the basis of securities trading, it paved the way for the decentralized exchange to issue its own security token (NEX), and raise money from retail investors. Further, since Lichtenstein complies with EU rules, the FMA ruling also allows NEX to be listed with any conventional securities exchange across the whole of Europe.

Switzerland

While the prospectus directive does not directly apply to Switzerland, the Swiss Financial Market Supervisory Authority (FINMA) is currently harmonizing much of its regulatory framework with MiFID and the EU prospectus directive. In November 2018, Tokenstate successfully conducted an STO in Switzerland, making it one of the first in Europe.

One of the advantages of conducting a token offering in Switzerland is the clarity that FINMA provides, classifying tokens into four categories: payment token, utility token, asset token and hybrid token. If a token is classified as an asset token then it will operate under MiFID-like rules adopted by FINMA.

Malta

In Malta, STO regulation is overseen by the Malta Financial Services Authority (MFSA) under the provision of a new law called the Virtual Financial Assets Act 2018. In order to conduct any token offering in Malta, a financial instrument test must be completed for MFSA classification. In the case of security token offerings, these would fall under EU harmonized legislation.

Gibraltar

Gibraltar is carving out a name for itself within Europe as one of the most blockchain-friendly areas to conduct an ICO or STO. Importantly, Gibraltar is also home to the Gibraltar Blockchain Exchange, an institutional-grade token sale platform and cryptocurrency exchange. The main market is regulated in line with MiFID and as such recognized by the EU. Projects that wish to be vetted for the GBX grid can do so with the help of AmaZix, which is a partner of the Gibraltar Blockchain Exchange.

Germany

In Germany, Neufund skirted around the BaFin regulatory authority by conducting an STO for high net worth individuals only. As one of the exemption classes, this allowed Neufund to conduct its security offering without regulatory approval. Since then, the company has been working with the agency to seek approval for retail investors post-sale. No decision has yet been made.

The UK

In the UK, the new prospectus issue exemptions have already been passed into law as part of the Financial Services and Market Act, but if Britain leaves the EU before July any further changes may not be applied. At present, both the UK’s Financial Conduct Authority (FCA) and ESMA are working to avoid any split in the legislative structure post-Brexit. The FCA has not released any specific guidance on blockchain technology, leaving the UK in an uncertain position in regards to crypto assets as well as its future relationship with the EU.

The Future

The EU has generally been a favorable ground for ICOs and STOs to date, with the ESMA plumping for the carrot over the stick. The goal from a Europe-wide perspective is to encourage companies to join the regulated market while warning investors away from unregulated ICOs. Further progress could be made in this regard with greater harmonization and greater clarity on what constitutes a security at an EU level. Until then, there remains a great deal of complexity in the European market.

The present blog post cannot and does not contain legal, fiscal or business advice. These legal information are only for guidance on matters of interest and for general informational and educational purposes. Therefore, the present blog post should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers and we encourage you to consult with the appropriate legal professionals, licensed attorneys, tax and business advisors in order to examine the actual facts involved. All information in this blog post is provided “as is”, with no guarantee of completeness, accuracy, timeliness. In no event will AmaZix be held responsible for any party’s use of the information contained in or linked from this blog post or for any decision made or action taken in reliance on the information in this blog post.

Originally published at https://www.amazix.com.

By AmaZix Editorial on May 2, 2019.

Exported from Medium on January 30, 2020.