Decentralized Finances (DeFi) and Non-Fungible Tokens (NFTs) are considered the two most significant breakthroughs inside the blockchain ecosystem in the last years. Their capacity to create a new value layer above the highest sense of equity, security and privacy standards in many sectors of each society is unmatched by anything else.

Industries like media, publishing, sports, entertainment, music, charities, and others will be transformed entirely, forcing us to rethink how we do things in many aspects of our lives.

But are we still in the first stage (drastic growth) of these niches? What should we expect in the future?

DeFi and NFT Were Born Giants

The term DeFi, short for decentralized finance, was born in 2014 when the Maker project was built on top of the Ethereum blockchain. It has remained one of the most critical projects in DeFi and is perceived as one of the early pioneers of the whole decentralized finance space.

Meanwhile, NFT (non-fungible token) had a progressive birth since colored coins in 2012, passing through rare pepes in 2016, and finishing in CryptoKitties in 2017. As you can see, the NFT concept was built from the ground up under the Bitcoin blockchain, but it acquired its actual capacities when it was built on top of the Ethereum Network.

Both sectors of the crypto ecosystem were born to run, not to walk, where their concepts synchronize harmoniously. Numbers speak for themselves:

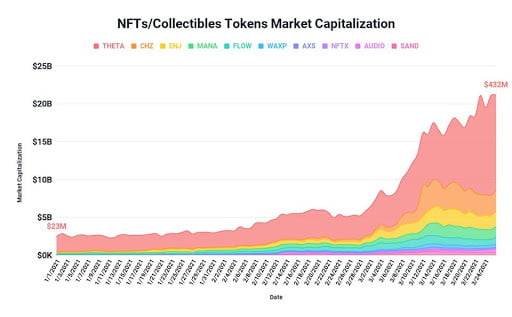

The chart above shows USD $20.3 billion that the non-fungible tokens (NFT) market cap has started to grow exponentially since the end of February.

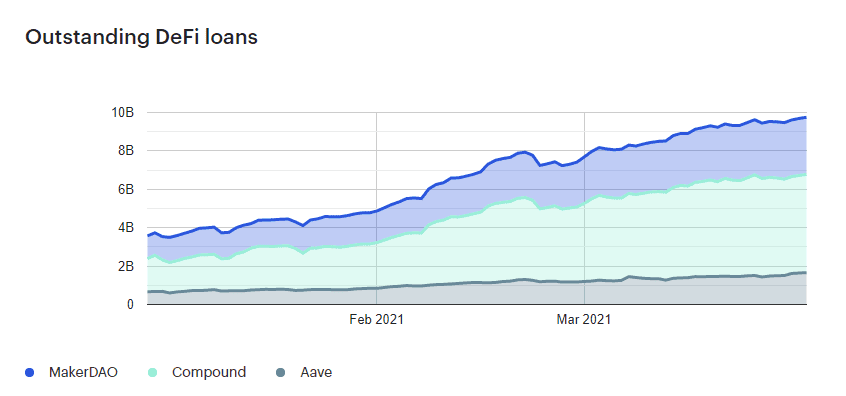

On the other hand, an excellent DeFi indicator where you can see how the sector is evolving is DeFi loans, where April 2021 reached USD $10 billion.

DeFi and NFT Potential Uses

These sectors still have a long way to go, and, given their potential, this breakthrough revolution has only just begun. The only way to see how far these sectors still have to go is to look at their potential applications, many of which have not yet been initiated.

DeFi's Important Applications

For a market created less than ten years ago and with a market cap of USD $66 billion (May 2021), this sector has evolved rapidly in all its. Nevertheless, there are still few companies for each of them: (Statistics, April 2021)

- Borrowing/Lending: Nowadays, there are 11 companies.

- Savings: You can find three platforms now.

- Decentralized exchanges: This sector of DeFi is the one with the most competition with 37 platforms.

- Insurance: There are three crypto companies in this sector.

- Derivatives: 14 crypto platforms for now.

- Staking services: With 13 companies in staking.

- Yield farming services: 12 crypto companies in this niche.

The number of decentralized finance platforms in each of DeFi's sectors will grow even more, making the benefits to the end customer even better.

NFT's Important Applications

The NFT is only four years old and already has a market capitalization of USD 20.3 billion (April 2021). It has only been used to represent images, music, and collectibles, now imagine what the market will be worth when they start using it with their other applications:

- Fashion: Consumers may quickly check the ownership details of their goods and accessories online, reducing the risk of counterfeiting. Users could simply scan a QR code found on price tags for apparel and accessories in the form of an NFT.

- Licensing and certifications: Effective applicants are typically given course completion certificates in either digital or paper format, similar to any other degree or license. Before an organization or an institute offers a job to anyone, universities and employers request replicas of the course completion document as references. On this basis, it is ensured that the certificates are genuine.

- Sports: Some of the most severe problems plaguing the sports industry are counterfeit tickets and merchandise.

- Domain services: Crypto addresses are built as non-fungible tokens platforms by Ethereum Name Service and Unstoppable Domains. Myname.crypto and myname.eth are two notable examples of non-fungible token applications. A user's crypto address is identical to their Twitter or Instagram username, except that each name is unique.

- Videos: Initiatives like videocoin and filecoin will create a marketplace for videos with nonfungible tokens (NFTs), solving a significant pain point for video authentication.

Will DeFi and NFT Stay in the Ethereum Blockchain?

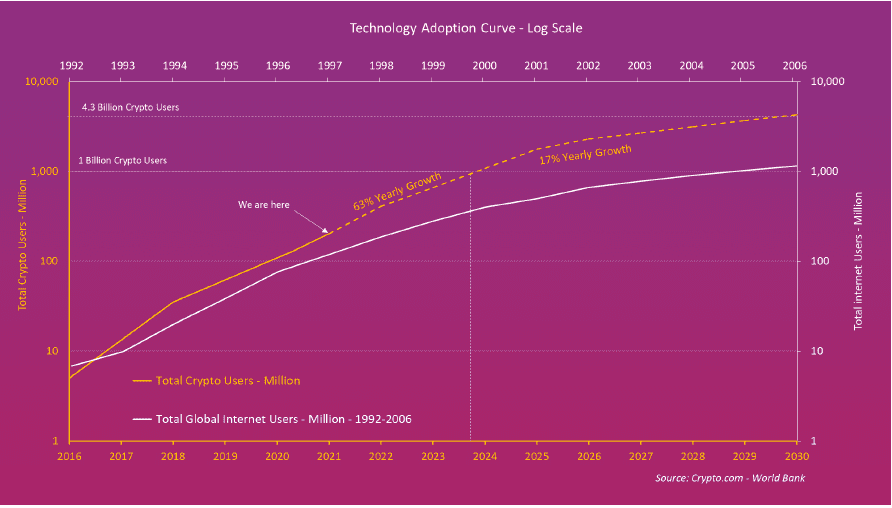

In terms of users, the crypto space is rising at a rate of 113% per year. Even if it slows to the 63% pace of network adoption that the internet saw simultaneously, it will result in 4 billion users by 2030 or earlier.

These figures only confirm that the crypto ecosystem will grow uninterruptedly. However, we do not know which blockchains the different initiatives will be distributed. Currently, the ETH Network is used in 92% of Decentralized Finance platforms, and 80% of the top 15 NFT collections are built on top of the Ethereum blockchain.

Will NFT Dominance Migrate to Another Blockchain?

Given this growth rate, one question is inevitable — What other blockchains have the same or even more potential to develop NFT projects?

Did you know that the creators of CryptoKitties were the ones who developed the Flow blockchain? They realized that the Ethereum blockchain was limited to the development of the famous game and therefore decided to create their blockchain, which specializes in video game creation. Flow network also deploys NBA Topshot, a USD 568 million market cap located in the 4th position of top 15 NFT collections.

Will DeFi Ethereum’s Hegemony Move to Another Blockchain?

At the moment, the preferred blockchain for developing DeFi projects is Ethereum because it is the largest crypto developer community in the ecosystem. However, there will come a time when, thanks to the intrinsic limitations of the Ethereum network, new projects will start to be built on the Polkadot, ChainLink, Cardano, Solana, and Near blockchains because they offer much cheaper and faster transactions fees interoperability capacity between DAO’s, new proof-of-stake protocol (sharding), among other characteristics.

DeFi and NFT Are Trees - Tokenization of Asset Management Will Be the Forest

The tokenization of the asset management business is beginning to appear, which has enormous potential far beyond decentralized finances and NFTs. Yet, it will be even more significant in the immediate future as crypto users want to diversify but are beyond the old scheme.

The property of any kind will then start being tokenized. We would then be in the fields of IP, supply chains, insurance, legal, and identity tokenization (+KYC) which this new tokenized wave will drastically transform these sectors. On the other hand, Diem (Facebook’s cryptocurrency) would accelerate all of this massively, and CBDC's position in adding fuel to the crypto ecosystem’s flames.

Don’t lose the opportunity to learn how NFT and DeFi can make you improve what you are doing right now with your money and digital assets.