Last updated: May 7th, 2019

Understanding tokenization and Security Token Offerings (STOs) is extremely important for issuers and regulators alike. Put simply, tokenization is the conversion of an asset into a security token that exists on the blockchain. Tokenization unlocks capital from global investors as it enables access to secondary markets. An STO is the issuance of security tokens. STOs provide an innovative solution to the problems facing the private market for the issuance and trading of assets. Security tokens represent an intersection between digital assets and traditional financial products. Due, however, to their great complexity, STOs are difficult to manage and are often poorly understood.

Accompanying the rise of security tokens came a host of STO platforms to support issuances. STO platforms are protocols that manage the entire lifecycle of a security including issuance, custody, KYC checks and secondary market trading. STO platforms can contribute to an efficient issuance and transfer of securities at a low cost while avoiding counterparty risk. They facilitate the integration of the financial system, according to regulatory rules, under one common standard that provides synergies to all participants. These platforms also tackle the long-term liquidity issue that illiquid assets face by democratizing private assets and, thereby, improving market depth.

This post will identify all major STO platforms; summarize their uses, features, strengths and weaknesses; and rate each platform using five relevant criteria categories. This analysis should prove invaluable to anyone in the cryptosphere pondering the best launchpad for their security token offering.

Category marking criteria

Each security token platform has been rated for various attributes and assigned a cumulative score ranging from 1–15, with a higher score according to a higher rating.

How decentralized is the platform? (0–5): Decentralization, along with the permissionlessness, trustlessness and censorship resistance that it enables, is the core value added of any system operating at the blockchain level. Platforms that incorporate mechanisms which self-govern the protocol will receive higher marks than those pursuing a traditional monopolistic approach where decision making and risk are centralized at the top of the chain.

This category rewards:

- Platforms using open source frameworks that enable other companies to build on top of the protocol, thus allowing for interoperability as well as providing for more competition and reduction in the cost of services provided.

- Incentive mechanisms created at the token level where the interests between issuers and other participants are properly aligned.

- Direct peer to peer trading that provides investors with the option to trade between themselves without counterparty risk or the need for intermediaries.

- The provision of tools that give investors control over their assets.

- The protocol’s inability to freeze and transfer investors’ securities without their consent. This would allow for a truly decentralized system, but it is questionable whether it would conform to securities legislation.

Each of these will add 1 point to the valuation of the category.

How is KYC baked in? Privacy concerns (0–3): Safe storage of private information is paramount to the credibility of any company. At the trading level, it is essential that data is secure but the capacity for verification and auditability is equally important. Without auditability the regulatory framework is not achieved and therefore the legality of an STO is lost. Exchanges must be able to verify investors’ data when transferring security tokens and regulators must be able to confirm that all procedures are being conducted according to the predetermined rules, without revealing the underlying/private data.

Protocols that are able to keep data on chain where validation is completed through mechanisms developed at the blockchain level will receive more points than protocols that rely on centralized institutions to keep private data safely. 3 points are awarded for protocols that store data on-chain. If private information is kept with centralized institutions we will consider the reliability and reputation of these institutions. 1 or 2 points are awarded for protocols with reputable companies and 0 points for protocols with non-reputable companies.

Tokens issued (0/4): Several platforms have issued security tokens. Few, however, have raised capital for issuers. Protocols that have already issued security tokens and successfully raised capital have, in our eyes, demonstrated that their protocol is functional and possesses a network of investors. This is a very positive sign for potential issuers in this emergent industry.

A maximum of 2 points will be awarded for platforms that have had token issuances depending on the number of security tokens issued. A further 2 points will be awarded for platforms that have actually raised capital depending on the amount of capital raised.

Cost/ease of issuance (0–2): This category considers the ease of issuing a security token through each platform. The overall goal of every platform should be to facilitate the entire issuance process. In the traditional market, fundraising frameworks are complex and costly. STO platforms will receive points for 1) simplicity and 2) the provision of a full package since these things enable issuers to focus their time on improving the business.

2 points will be awarded for any platform that provides a full solution to the issuer. The cost of issuance and fees charged to investors will not contribute to the overall valuation of the platform because 1) these are relatively low when compared to traditional platforms and 2) most are subject to trading volumes. Nevertheless, a deep analysis on costs is conducted throughout the research.

Jurisdictions (0–1): Compliance with the existing regulatory framework is mandatory for the long-term success of any company when raising capital. Regulatory scrutiny has increased and most of the major global jurisdictions have established some kind of token regulatory framework. 1 point is awarded for being compliant in major jurisdictions: US, Europe, Asia.

Total (12/15)

How decentralized is the platform? (3/5)

How is KYC baked in? Privacy concerns (2/3)

Tokens Issued (4/4)Cost / ease of issuance (2/2)

Compliant jurisdictions (1/1)

Securitize is an issuance platform that supports the entire lifecycle of STOs, handling payment of dividends and voting rights. The project raised $12.5 million in funding led by Blockchain Capital and Coinbase Ventures. The platform is interoperable with other platforms. Given the lack of consensus in the industry, interoperability is incredibly valuable since issuers simply cannot afford to choose the wrong protocol. With the first-mover advantage and having already raised $130 million on its platform, Securitize has taken the lead in the issuance business.

Smart contracts that are handled by the compliance service guarantee that investors on both the platform and on exchanges comply with regulatory and issuers’ rules. Know your customer (KYC) is backed by the issuance platform and partially fed into the whitelist for accreditation internally and externally with off chain APIs. This enables the sharing of KYC status, expiry date and information hash from verified exchanges only. The platform has partnered with a number of third parties that provide tools for issuers and investors. Issuance costs are relatively high compared to other platforms.

How decentralized is the platform? (3/5): The process is partially centralized at the issuer level with only one issuance platform (Issuance, Inc). This does, however, guarantee a compliant process. The whitepaper also discusses possible API issuances. Securitize allow direct P2P trading as long as participants are approved at the regulatory and issuer levels. Distributed securities exchanges are possible since external exchanges can add their investors’ KYC data to the on-chain whitelist of the protocol thus allowing validity checks of external investors. In accordance with regulatory requirements, issuers will go through a whitelist to execute actions (e.g. dividend payment) and trigger specific events (e.g. freezing stolen tokens/ re-issuing lost tokens). Securitize’s adaptation layer secures Digital Securities (DS) tokens for various regulatory compliance protocols. This allows compliant token securities trades on AirSwap and Open Finance Network. Others have announced their intent to support Securitize.

How is KYC baked in? Privacy concerns (2/3): The issuer or issuance platform keeps KYC data in their database, feeding limited information into the registry service (whitelist). Securitize’s off-chain API enables the sharing of KYC information between issuers and exchanges. This enables efficient of data validation on the platform and improves user experience on the exchanges. The API is open sourced and can be adopted by other issuers. This may bring more liquidity to the market.

Tokens Issued (4/4): The company has issued seven security tokens raising a total of $130 million. It has also integrated eight live exchanges on the protocol and is one of 10 companies to join the IBM Blockchain accelerator program with the goal to build the world’s first debt issuance platform (an $82 trillion market).

Cost / ease of issuance (2/2): Securitize provides a complete suite of tools and services for issuers and investors including issuance management, document handling, KYC/AML, wallet management, crypto escrow and distribution tools. Issuance is done through Issuance, Inc or through a DS app that provides a front end management interface to issuers. Afterwards, the issuance platform registers investors’ KYC information in the whitelist (KYC status of all investors) and issuers issue security tokens to investors.

Compliant jurisdictions (1/1): Securitize is compliant in all major jurisdictions.

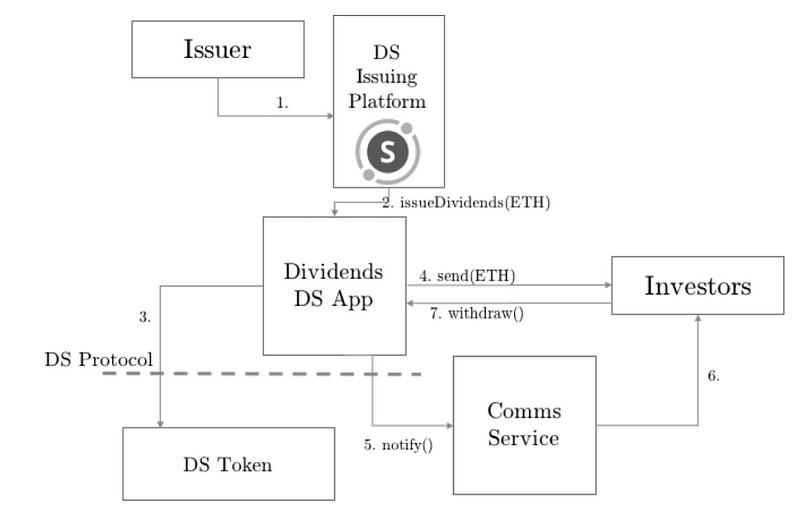

Dividend payment example

The issuer orders the issue of a dividend to the issuing platform that (1) instantly sends the amount of the dividend in ETH to the (2) dividend app (a contract that is associated with the token), the app then accesses the (3) whitelist in the protocol to see active investors (this is only possible at the protocol layer as ERC20 does not support this). If valid, it sends the ETH to the (4) investor’s wallet.

Total (10/15)

How decentralized is the platform? (4/5)

How is KYC baked in? Privacy concerns (1/3)

Tokens Issued (2/4)Cost / ease of issuance (2/2)

Compliant jurisdictions (1/1)

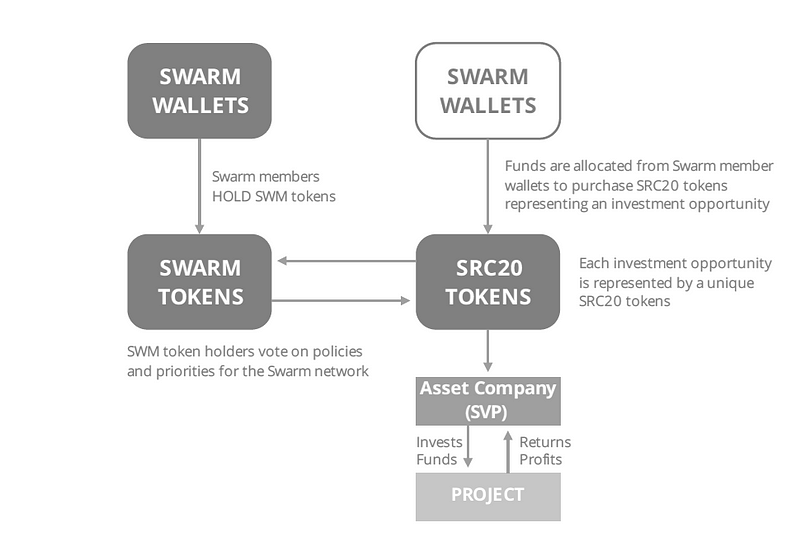

Swarm is a non-profit security token infrastructure model issuing on Ethereum. It features incentive mechanisms that provide high levels of decentralization when investing in tokenized projects and companies. SWM utility token (ERC20) is used to incentivize and reward participants that add value to the network. Projects deploy regulatory compliant SRC-20 standard security tokens representing ownership of the investment. This allows for compliant trading of these tokens in any network that supports Swarm’s open compliance solution Market Access Protocol (MAP). As an open source protocol that brings innovation and low costs due to competition, developers are incentivized to build on top of Swarm.

How decentralized is the platform? (4/5): Swarm’s decentralized network governance allows investors and issuers to execute voting mechanisms for a pool of assets running on the network. Swarm uses a stake weighted delegated voting system where voting power is directly proportional to the amount staked in the network and/or project. This allows for an efficient allocation of decision making according to the interests of investors. This is since the long term success of Swarm is subject to good decisions made by participants. (See figure below). Swarm’s open source protocol allows applications to be built on top to serve the marketplace (set up of funds, custodians, issuance platforms, etcetera). Swarm’s staking mechanisms align interests between investors and issuers, strategically opting to lock tokens as a Proof-of-Commitment. This brings significant benefits for both investors and fund managers when it comes to transparency in decision making.

How is KYC baked in? Privacy concerns (1/3): Service providers process investors’ private information, issuing them certificates of compliance and allowing them to trade any security token according to its regulatory requirements as set by the token issuer. After providing personal information, investors receive a decentralized identifier (DID) that allows them to invest in a given asset. After validating, the service provider will broadcast part of the information to the network where auditors and regulators can verify it through an API. Swarm is not dependent on a single whitelist for verification as other service providers can share the responsibility. Users are not fully dependent on the organization for the underlying protocol to operate.

Time to launch / Tokens Issued (2/4): The platform is live. Swarm recently raised $16 million in the Art Token STO.

Cost / ease of issuance (2/2): Issuers must stake SWM tokens to issue security tokens. They must stake between 0.2–0.5% of the net asset value under administration, with a minimum of $2,500, to keep the investment operational. The stake is locked in a smart contract for the life of the investment. The Swarm foundation has set aside a pool of 2.5M SWM to pay as rewards to token issuers against their stake.

Compliant jurisdictions (1/1): Compliant in all major jurisdictions.

Total (9/15)

How decentralized is the platform? (4/5)

How is KYC baked in? Privacy concerns (2/3)

Tokens Issued (0/4)

Cost / ease of issuance (2/2)

Compliant jurisdictions (1/1)

STACS Protocol is an STO platform designed by Hashstacs Inc. which is a joint venture between the GSX Group and the Hong Kong publicly listed company Chong Sing Fintech Holdings Limited. This lineage provides trust and exposure to high trading volumes since the GSX already possesses many institutional investors on its traditional securities platform. The live version is due for release at the end of 2019. Recently, the company swapped their original RKT for STACS tokens (ERC20) due to new rewarding and staking mechanisms at the protocol level. The STACS protocol is composed of:

- A permissioned blockchain (Native STACS) with verified partners. Regulated institutions will verify participants through KYC checks thus allowing for efficient issuance and trading of token securities with a 120k TPS.

- An open source public blockchain (Global STACS) that realizes data witnessing and consensus. The STACS utility token (ERC20) is used to pay listing and trading fees across the ecosystem.

Regulatory compliance is accomplished via a one-time validation of participants. The interoperability of the ERC20 token enables validation verification by third parties. Personal information is backed by VPs relying on the safety of their legacy systems to store investors’ private information safely. The STACS protocol is live since 25/02 with a first deployment through the GSX with a Bond demo. Trading on the GSX is expected to occur between Q3-Q4 of 2019. There are no joining fees for VPs to use the protocol. In order to lease the network, VPs will need to stake an amount of STACS tokens to participate.

“Our technology subsidiary,has been working hard to develop the STACS Network and has been actively engaged with exchanges and investment banks to build out the Securities Trading Asset Classification Settlement (STACS) Network, which we believe will transform capital markets. Our dedicated team of 40+ developers have been working around the clock to prepare the technology for a full roll out. We will begin to make some strategic announcements over the next few weeks and months.” — Nick Cowan, Founder & CEO — Gibraltar Stock Exchange Group

How decentralized is the platform? (4/5): The platform has a centralized primary issuance where an STO is issued through a nominated verified partner (stock exchanges, investment banks, broker dealers). After validation, issuers can issue securities on VP platform or on STACS Global. The latter enforces rights and regulatory standards of the STO through smart contracts (see figure below). A delegated proof of stake (DPOS) for consensus at the public blockchain level facilitates fair sharing of network gains among contributors. 70% of transaction fees will be distributed to nodes (payable in STACS tokens); 10% will be retained in a governance fund; and 20% will be allocated to Hashstacs for developing and maintaining the protocol. Custody takes place via a personal wallet where users manage their own private keys and assets through a mobile app. Storage via professional custodians is also available. An enterprise wallet that allows institutions to secure various other cryptocurrencies is available for a one-time fee.

How is KYC baked in? Privacy concerns (2/3): KYC information is stored off-chain with VPs that will send partial information to the public blockchain to realize data-witnessing so that auditors and regulators can confirm participants’ verification according to regulatory rules. A 51% attack on the public blockchain would tamper with the data provided by the VPs but would not give access to KYC private information stored in a centralized system. Hence the reliability of the VPs’ security systems is the main privacy concern. It is assumed that STACS’ VPs will consist of renowned and reputable financial institutions.

Tokens Issued (0/4): The first version of the live implementation has been released on 25/02 2019 with the deployment of a Bond demo on the GSX. Regarding trading, it is expected to be operational in Q3 on the GSX. In the meanwhile, additional VPs might join the STACS protocol and also accommodate trading before the end of the year.

Cost / ease of issuance (2/2): While the platform provides a full solution that tackles all regulatory hurdles, the whitepaper states that issuers must ensure the token’s legal and compliance framework. STACS’ API interface limits complex language to assure proper smart contract execution by issuers. There are no joining fees to use the STACS protocol, but VPs will need to stake STACS tokens to access functionalities.

Compliant jurisdictions (1/1): Compliant in all major jurisdictions.

Total (8/15)

How decentralized is the platform? (2/5)

How is KYC baked in? Privacy concerns (1/3)

Tokens Issued (2/4)

Cost / ease of issuance (2/2)

Compliant jurisdictions (1/1)

Harbor is an open source issuance and compliance platform built on Ethereum. Harbor’s focus is on real estate assets but it is currently piloting with private companies. Harbor’s long-term goal is an 80%-20% issuance portfolio of properties and companies respectively.

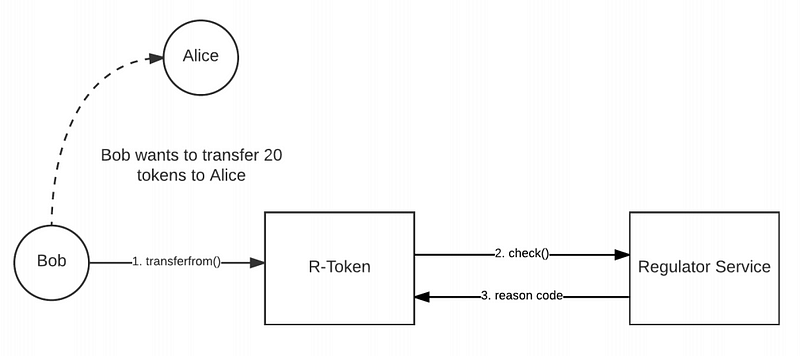

The R-Token Standard can enforce compliance across any trading platform that supports ERC20 tokens. R-Tokens allow for programmable logic around investor validation, regulatory norms and centralized vs decentralized trading. This is accomplished by overriding the existing ERC20 transfer method to check with an on-chain whitelist of approved participants that ensures trade approval.

How decentralized is the platform? (2/5): The platform is centralized. Harbor is solely responsible for regulatory requirements, mapping all participants’ data and KYC/AML. Harbor has promised to bring in more off-chain service providers to decentralize the network as the platform grows. Harbor is closed, therefore if the company goes away the issuer would have to re-issue tokens with a new provider. Harbor’s concentration in the decision making process through a single whitelist prevents hacking. Hacking is only possible if a hacker is validated by Harbor.

How is KYC baked in? Privacy concerns (1/3): Full KYC information is kept by Harbor. Partial information is fed into the regulator service (currently Harbor manages the whole process) that includes the whitelist. This is done to validate transactions between approved investors in off-chain exchanges. (See figure below).

Tokens Issued (2/4): Launched in 2018, Harbor has issued 50% of one REIT so far: The Hub at Columbia REIT worth roughly $21 million.

Cost / ease of issuance (2/2): Harbor has two models. The first model fully supports issuances with guidance on smart contract implementation, vetting of investors, compliance, token distribution and KYC/AML checks. The platform is quite selective with partners and focuses exclusively on high quality investments, charging a percentage in equity from the project so that interests are properly aligned. A second model involves distribution of the software as a SaaS for companies to control their assets with a set up and recurring fee.

Compliant jurisdictions (1/1): Compliant in all major jurisdictions with a full legal and compliance team in house that bridges the traditional and crypto worlds.

Total (9/15)

How decentralized is the platform? (4/5)

How is KYC baked in? Privacy concerns (0/3)

Tokens Issued (2/4)

Cost / ease of issuance (2/2)

Compliant jurisdictions (1/1)

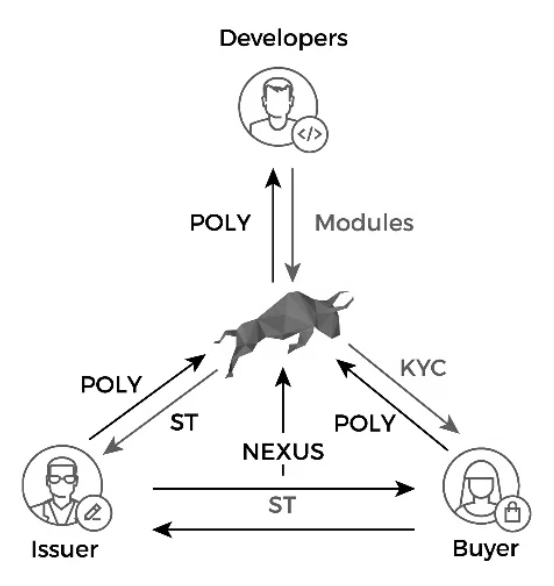

Polymath is a one stop shop for STOs. Polymath is an open source issuance platform that provides freedom to issuers and investors in choosing institutions (KYC providers and lawyers) for accredited certifications and developers to create the security token smart contract with a POLY token (ERC20) powering the system. The issuance process is led by bidding both at the legal delegate (lawyers) and developer level, creating incentives to ensure “skin in the game” opportunities for those institutions that want to provide honesty and quality in their work. As a signal of confidence given to token holders the company recently locked $9 million worth of Poly tokens for five years despite bearish market conditions. This represents 25% of the current circulating supply. Polymath recently created the ERC-1400 standard formerly known as ST-20, which operates as the base for other token sub-standards, with each standard having the ability to integrate with one another on different levels. This provides for more flexibility in modeling the lifecycle, trading, and management of security tokens.

How decentralized is the platform? (4/5): Polymath differs from Harbor in two ways: 1) it issued a native token and 2) the organization is not required for the underlying protocol to operate as issuers are in control of whitelists. Issuers decide on the rules necessary to validate investors. They can also create several whitelists and distribute them with other exchanges to enable greater liquidity for security tokens while assuring compliance.

Polymath does not directly handle the issuance process. There is, therefore, little need for the company to exert control over the system where investors and issuers have the freedom, based on incentives, to choose entities for legal verification. The CEO, Trevor Koverko, believes in a self-service approach in order to scale. Therefore, issuers must undertake due diligence measures on service providers who they wish to share whitelists with to assure credibility before giving control to others when managing the verification process. Issuers are responsible for regulatory verification.

With the introduction of Polymath core v2.0.0, issuers can force transfers, interestingly the protocol gives issuers the option to turn forced transfers off permanently to signal investors to full decentralization. Tokens can only be moved off an exchange to whitelisted addresses. Other parties can, however, validate outside the control of Polymath. The likelihood of bad actors being on whitelisted is relatively high.

How is KYC baked in? Privacy concerns (0/3): Investors’ and issuers’ data are held by KYC providers and legal delegates respectively. Though providers pay a Poly token fee to join the network, the risk of a data breach is significant, especially since average investors must do all due diligence. KYC providers and legal delegates use Polymath.js to record necessary information on the blockchain for others to audit via a proof of process that allows partial information to be shared without releasing full access to participants’ private data.

Tokens Issued (2/4): The platform is live with 40 securities deployed on the network. It is unclear whether or not capital has been raised for any of these companies. Polymath has created partnerships to issue security tokens for MintHealth (healthcare) and Pegasus fintech (financial services). The company has partnered with Maker DAO so that issuers can price STOs in USD, allowing for the stability of fundraising targets.

Cost / ease of issuance (2/2): Issuers pay a fee to issue security tokens, buyers pay a fee for verification and developers receive fees to develop token contracts. (See figure below). Issuers can post bounties in Poly tokens to encourage legal delegates to process the issuance of their assets and developers to advise on token model construction. Legal delegates bid to process issuance and provide a URL link with information about their service, allowing the issuer to make objective decisions on quality. The risk of scams is reduced by 1) a fee to be paid by the legal delegate to join the network and 2) the issuer’s ability to track the number of issuances done by a particular legal delegate. The legal delegate can also stake Poly tokens to guarantee the quality of the work. These will be destroyed if a % threshold of security token holders vote to do so. The cost of issuance is a reflection of the desired quality of work.

Compliant jurisdictions (1/1): Polymath is compliant in all major jurisdictions.

Total (8/15)

How decentralized is the platform? (2/5)

How is KYC baked in? Privacy concerns (3/3)

Tokens Issued (1/4)

Cost / ease of issuance (1/2)

Compliant jurisdictions (1/1)

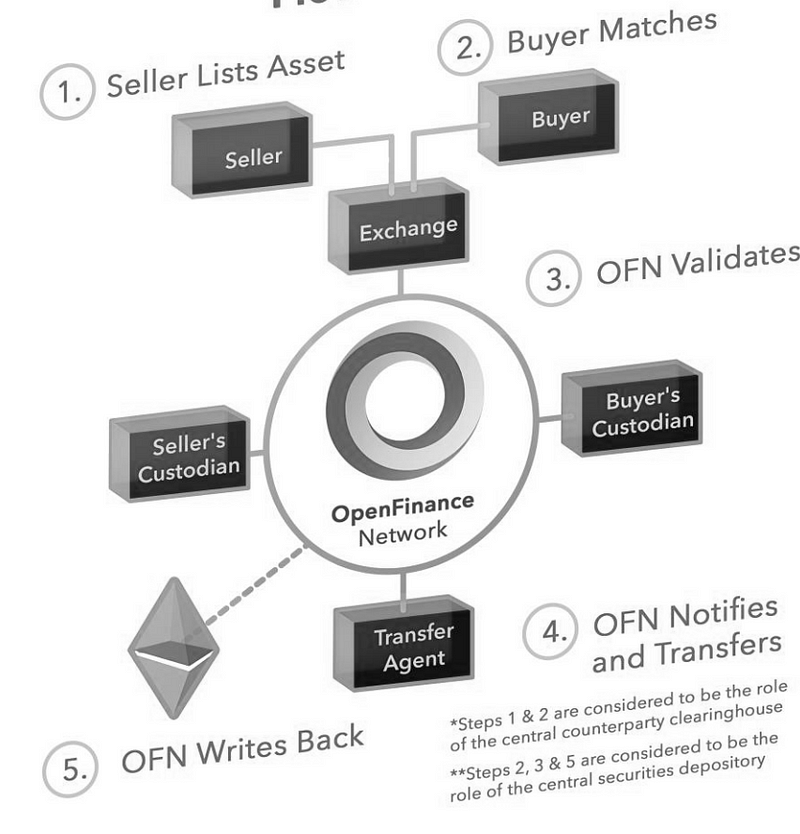

Established in 2014, the OFN platform is built on the Ethereum blockchain. Initially designed for clearing and settlement processes, OFN’s current focus is on the secondary trading of assets on its platform having recently moved from beta to full trading functionality with a significant number of partnerships with other STO platforms. As an incentive to hold, ERC20 token holders receive 10% of gross revenue.

OFN’s simple verification process facilitates the efficient trading of securities on secondary markets. Investor “passports” allows investors to interact with other service providers that are registered in a public registry where a decentralized system (see below) handes the clearing and settlement process. This contributes to liquidity in the industry. OFN’s open source platform acts in a permissionless manner, allowing other participants to build on top of OFN and bringing in services that the issuer and investors require.

How decentralized is the platform? (2/5): Sageworks Capital is OFN’s sole broker-dealer for securities. Participants can interact with the framework off-chain through network adaptors (website, mobile app or API) though these are currently in production. According to OFN’s website all accreditation of participants is done in house through a trading desk, but according to the whitepaper an issuer can be validated through a qualified entity to register the asset. As an open source protocol participants and developers can build on top of the framework, boosting innovation and the provision of services where the token can be sub-licensed to other participants.

How is KYC baked in? Privacy concerns (3/3): KYC is handled via a side chain that is hashed to the public chain. After validation, a passport confirming approval to hold and transact securities is given to the investor. Sensitive data that is stored in a secure federated side chain, with a zero-knowledge proving system, is auditable and can be verified by regulators and other trusted entities in the public blockchain without leaking the underlying data.

Tokens Issued (1/4): Though updates on API connections and interfaces, institutional tools development, and volume of users are still pending, OFN has a considerable amount of security tokens trading on the platform. Partnerships include Spice VC, Protos Management, Minthealth, Blockchain capital, Science Blockchain, Citizen health, Corl; (3 of these currently trade on OFN due the compatibility protocol developed by Securitize).

Cost / ease of issuance (1/2): Issuers perform due diligence processes with a validator (OFN currently acts as the validator) to register and issue tokens. They will receive a standardized process for compliance, transfer of ownership and distribution of proceeds. Custody is currently managed via Metamask though the company is aiming to partner with a specialist custody provider. The token acts as a license to the platform. Transaction costs are adjustable based on the needs of the network. On the company’s website, fees are 2.5% (1.5% OFN token) to the buyer and 1.5% (0.5% OFN token) to the seller.

Compliant jurisdictions (1/1): The platform is compliant in all major jurisdictions.

Total (10/15)

How decentralized is the platform? (3/5)

How is KYC baked in? Privacy concerns (2/3)

Tokens issued (2/4)

Cost / ease of issuance (2/2)

Compliant jurisdictions (1/1)

Tokeny is a compliant tokenization platform and a permissioned network based on the Ethereum blockchain for the clearing and settlement of assets and transactions. The company is focusing on mid cap companies (too big to be easily acquired and too small for an IPO), private equity and real estate funds to provide liquidity to limited partnerships, debt instruments and commodities. Tokeny has 18 clients listed on the platform, two of which are issuances performed at the protocol level.

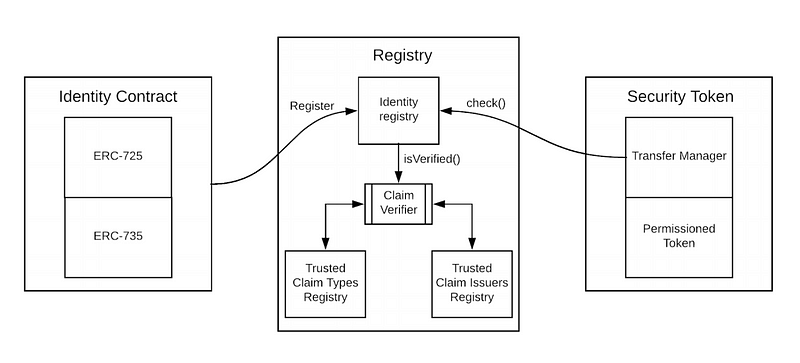

How decentralized is the platform? (3/5): Tokeny’s efficient validator system allows issuers to control transfers and enforce compliance on token holders. This is achieved through an identity contract that is deployed once by each user to interact with security tokens. Validation certificates (KYC) are granted by trusted parties (KYC providers) chosen by the issuer. These certificates are kept on a registry and signed on-chain by a transfer manager (smart contract) that confirms whether an investor complies with regulatory rules and issuer requirements. (See figure below).

How is KYC baked in? Privacy concerns (2/3): KYC is backed by trusted parties (KYC providers), therefore personal data is not stored on-chain, only the validation certificates (identification contract) issued by trusted parties are used by the transfer manager (smart contract) to validate whether or not participant can hold or transfer the token. Currently, Tokeny is the only trusted party in charge of validating all users. Nevertheless, the platform is already working with reputable KYC providers (Deloitte, Identitymind, Onfido).

Tokens Issued (2/4): The platform is live but access is only possible through the Ethereum blockchain without an application (API) to access the platform. This will have an impact on the initial uptake for this platform as the majority of retail and institutional investors are not familiar with blockchain infrastructure. The CEO of the company has confirmed two STOs: Mash Group, a Finnish company that specializes in payment solutions, and Leaseum Partners, a real estate fund that is looking to raise $250 million. Tokeny launched Blockport STO on the 16th of April 2019.

Cost/ease of issuance (2/2): Issuers can delete, update and add to the registry for validation of issuance management entities. This may be an issue as fraudulent issuers could add fake companies to validate their own fraudulent processes. The platform provides a full service for issuers and investors by linking to service providers in issuance management, document handling, KYC/AML, wallet management, crypto and fiat escrow and distribution tools.

Compliant jurisdictions (1/1): The company is compliant in all major jurisdictions.

Securrency was created in 2015 as a compliance software company. The company assists issuers with the legal framework and transaction of securities. Securrency also provides information reporting regulatory checks and taxation services. The company has also developed a smart contract to deploy these services and enables APIs for any type of trading activity. The company provides a full service on its platform and works as a one stop shop, as it recently announced a partnership with Share Post for the issuance of token securities.

TrustToken raised $20 million and is backed by Andreessen Horowitz, Block Tower Capital and ten other venture capital funds. TrustToken is a protocol for security tokens where issuers add logic to smart contracts (SmartTrust) for trading and ownership. Issuers choose a trusted entity, validated institutions that have been audited by regulators with billions in assets under management, rather than having to rely on a centralized institution to manage the entire process. The company supports Reg. D and Reg. CF, making it simple to build frameworks for securities.

Orderbook is a compliant decentralized trading platform that provides support on all legal framework. It supports both primary STOs and secondary market offerings. Two security tokens currently use its software. Orderbook adds logic to token transfers and blocks illegal transfers. The blocking mechanism is run by smart contracts and executed via the Ethereum blockchain through Orderbook’s “ RAP “ technology. The platform has 60 inhouse developers, provides its own wallet to investors and is becoming a broker dealer. Partner institutions will provide the remaining services.

A Danish compliance platform focused on transaction clearance and settlement. GoSecurity does not provide participants with legal help. GoSecurity seems primarily focused on acting as a software service rather than a full service protocol. The software will be live by April 2019. There is currently a limited number of partnerships at the custodian level. The protocol nevertheless has two potential issuers in the pipeline. GoSecurity is undertaking their own STO on the platform as a pilot project. Dividends and voting mechanisms can be implemented at the software level.

Platform guidance

By platform

Securitize: For companies requiring a full service for their legal framework and smart contract implementation and demand guarantees of token compliance into the future, as the software is easily adapted to changes in regulation.

Swarm: For investment funds that continuously require capital to implement new projects. Investment opportunities can be tokenized, representing a particular project.

STACS: For companies who can delay their issuance until the end of the year and require full service for their legal framework.

Polymath: For companies that want to eliminate complexities from crypto volatility. Polymath guarantees ease of issuance with stable coins that peg all calculations to fiat, eliminating the need to continuously update numbers when preparing filing documents.

Harbor: For companies wanting to issue real estate assets.

Tokeny: For companies looking for full guidance and support through a centralized platform that fully addresses regulatory requirements.

Securrency: For companies that do not necessarily want the provision of all services but may require or request the full service in the future. The protocol sells all services in five different products, unbundled.

TrustToken; Go Security: For companies wanting to use the smart contract software as a service for a lower cost.

Open Finance Network; Orderbook: For companies wanting exposure to high trading volumes. These platforms specialize in secondary markets.

By use case

Issuers looking for ease of issuance; complete tools and services from issuance management, document handling, KYC/AML, wallet management, crypto escrow and distribution tools; and support in the legal framework should take Securitize, STACS, Securrency and Tokeny into account.

Those wanting to benefit from decentralization should consider hybrid platforms that deploy a utility token with mechanisms that ensure transparency when signalling long-term intentions and platform direction (voting). Swarm, STACS and Polymath implement self-enforcing mechanisms that distribute the gains of the network. Polymath gives issuers the option to turn forced transfers off permanently.

Issuers looking for the issuance of real estate assets should target Harbor. They are the market leader in this space having already issued a real estate REIT ($21m student property). The CEO of Harbor, Josh Stein, worked as general counsel in six different industries for almost twenty years, gaining significant connections in the regulatory landscape working for the United States department of justice.

Issuers that simply require the smart contract technology providing for the automation of regulatory compliance in a more efficient manner can reach out to platforms that license the software for a low fee as the entire lifecycle of the token security will be managed by the issuer. Go Security and TrustToken are good examples of this.

For issuers that prefer an exchange with more listings and traders, Open Finance Network and Orderbook could provide higher volumes in the trading of assets.

Originally published at https://www.amazix.com.

By AmaZix Editorial on May 7, 2019.

Exported from Medium on January 30, 2020.