The trouble with governance

In the era of crypto networks, prospective investors are often reluctant to commit to any project that promises less than absolute decentralized community management. The crypto community looks with great suspicion upon projects that do not offer voting rights to token holders and retain centralized governance. Teams that are unable to resolve the issues surrounding governance risk seeing their project run adrift, rudderless and incapable of onboarding the caliber of investors they covet.

Implementing fair voting systems is an incredibly difficult undertaking for new decentralized projects. It is hard to successfully balance the vision of absolute democratic governance, where every decision is made by the community, and the need for technical expertise in the decision-making process for more complex problems. Logically, community-focused issues should be voted on by the community while technical decisions should be solved by those with expert knowledge who can make truly informed decisions. Executing this dynamic, however, remains challenging.

First, some central authority must decide what constitutes a community issue and what constitutes a specialist issue. This authority runs the risk of unfairly arbitrating what does and does not warrant a vote. Second, the very concept of an expert body that is granted the privilege of voting on issues that the rest of the community cannot contradicts the crypto ethos of decentralized community management. Third, it is conceivable that a known body of experts could be bribed or pressured to vote in a certain way.

The search for solutions to the governance problem

The identification and resolution of potential issues is a major component of the advisory service we provide to our clients at AmaZix. Governance emerges time and time again as an issue that teams struggle to manage effectively. To ensure that we are well positioned to advise our clients on this evolving discipline, we are always seeking solutions from the best thinkers on matters of blockchain governance.

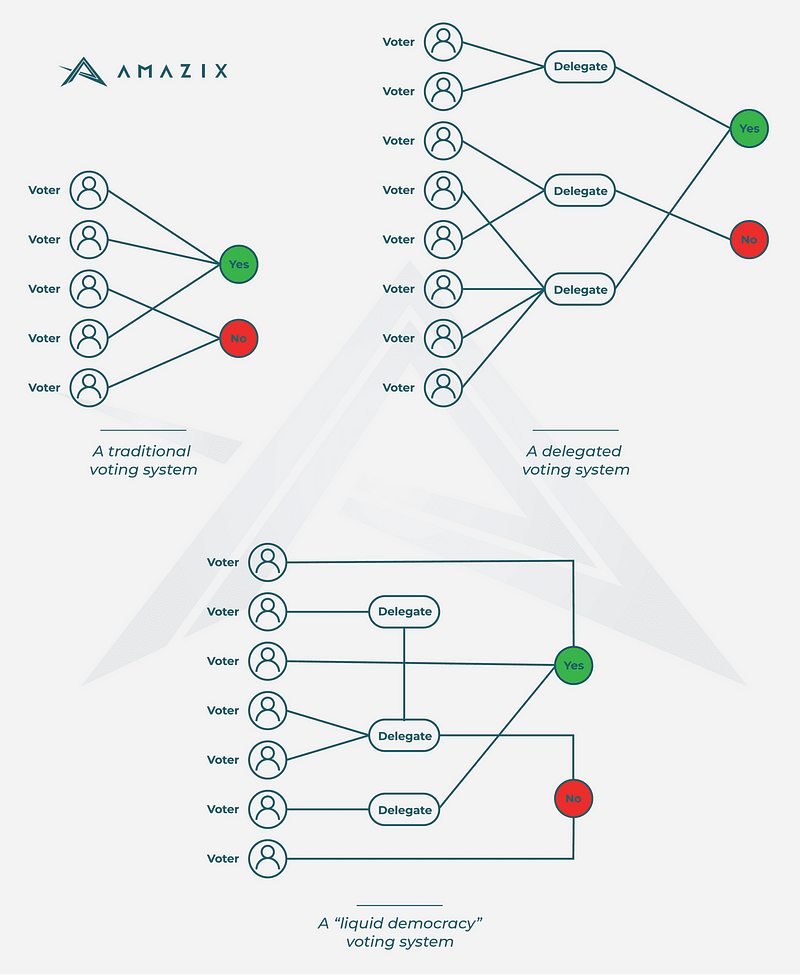

In the course of our research, we recently came across A Treasury System for Cryptocurrencies: Enabling Better Collaborative Intelligence by Bingsheng Zhang, Roman Oliynykov and Hamed Balogun. In this paper, the authors present a provably secure treasury system that supports liquid democracy/delegative voting (a system in which voters can either vote directly on proposed projects or delegate their votes to experts) for better collaborative intelligence. As the authors state:

“ core component is a universally composable secure end-to-end verifiable online voting protocol. The integrity of the treasury voting decisions is guaranteed even when all the voting committee members are corrupted.”

We reached out to one of the authors, Dr. Bingsheng Zhang, to discuss the significant potential of this proposed treasury system.

Bingsheng Zhang interview

AmaZix: Can you give us an overview of your research?

Dr. Zhang: A key feature expected from cryptocurrencies and blockchain systems is the absence of a centralized control throughout the entire operational process. That is, a decentralized blockchain solution should neither rely on “trusted parties nor powerful minority”, nor introduce such (centralization) tendencies into the development and maintenance of these system components. Therefore, ideally, no single authority or organization should be able to steer the direction of blockchain evolution without reaching a consensus of stakeholders.

My research is to develop a “community-inclusive” decentralized collective decision-making mechanism for blockchain governance, such as treasury management. During each treasury period, project proposals are submitted, discussed, and voted for; top-ranked projects are then funded. In particular, the proposed treasury system supports liquid democracy/delegative voting for better collaborative intelligence. Namely, the stakeholders can either vote directly on the proposed projects or delegate their votes to an expert who is knowledgeable and renowned in the corresponding area.

AmaZix: What kinds of applications do you see for the model?

Dr. Zhang: The proposed decentralized collective decision-making mechanism is compatible with most existing off-the-shelf cryptocurrencies/blockchain platforms, and it enables many applications in the blockchain context. For instance, our systems can be used for general-purpose blockchain governance beyond the treasury management scenarios — say, software updates.

It can also be used to certify/endorse out-of-band data on the blockchain, bridging the outside world to the blockchain context. Some blockchain companies are adopting a variant of our system for their blockchain oracle service. In the future, we will also apply our model to realize prediction markets.

AmaZix: What are the future implications of your research within the cryptosphere?

Dr. Zhang: Real-world blockchain systems require steady funding for the continuous development and maintenance of the systems. Therefore, secure and “community-inclusive” long-term sustainability of funding is critical for the health of blockchain platforms.

In the early years of blockchain, the development of cryptocurrencies such as Bitcoin mainly relied on donations and funding from patron organizations. More recently, an increasing number of cryptocurrencies have been funded through initial coin offerings (ICOs).

A major drawback of donations and ICOs is that they do not constitute a sustainable funding supply. Consequently, they cannot be relied upon as long-term funding sources for cryptocurrency development due to the difficulty of predicting the amount of funding needed or that will be available for future development and maintenance. Our research aims to resolve the funding sustainability issue for long-term cryptocurrency development and maintenance via the proposed treasury system.

AmaZix: Has any new progress has been made on your work since the publication of your paper?

Dr. Zhang: Yes. We are currently in the process of designing a new treasury system that is more efficient with respect to both communication and computation. One of the key focuses of the new treasury system will be improved scalability.

AmaZix: Do you know of any crypto teams that are interested in applying your work?

Dr. Zhang: Yes, Horizen is going to adopt our treasury system. Besides this, we have been approached by many teams who are interested in applying our treasury system to their projects. Some of them are using our system for blockchain data authentication.

AmaZix: Now that you have published your paper, what will you be working on next?

Dr. Zhang: We are currently focused on implementing my new “Statement Voting” concept into the blockchain decision-making context. In statement voting, instead of defining a concrete election candidate, each voter can define a statement in his/her ballot but leave the vote “undefined” during the voting phase. During the tally phase, the (conditional) actions expressed in the statement will be carried out to determine the final vote. You can read about it here: https://fc19.ifca.ai/preproceedings/97-preproceedings.pdf

AmaZix: Thanks Dr. Zhang.

Dr. Zhang: Thank you.

Conclusion

The proposed treasury system goes some way to solving the issues with voting detailed at the outset, and have the potential to significantly alter the nature of governance in the cryptosphere by facilitating greater decentralization.

AmaZix

If you’re working in the crypto space and are concerned about governance, looking to launch a token, or just want help managing your community then reach out to AmaZix.

We are the largest provider of full-service advisory to blockchain businesses. Our analyst team, comprised of some of the brightest minds in the industry, has meticulously assessed over 300 projects and played a pivotal role in refining the governance procedures, token economics and whitepapers of major tokenized projects.

For more information, contact us here.

Dr. Bingsheng Zhang

Dr. Zhang is the program director of Lancaster University’s Master’s degree in cyber security, and leader of the security research group. He specializes in secure multi-party computation, verifiable electronic voting (e-voting), and zero-knowledge proofs. In recent years, his research efforts have focused mainly on secure computing, collective decision making, and blockchain security. Dr. Zhang is currently a research fellow at IOHK LTD. and collaborates with IOTA and Ergo platform on EPSRC projects.

IOHK

IOHK is a digital technology company committed to using peer-to-peer innovations to provide financial services to the three billion people who don’t have them. IOHK was the first among blockchain technology companies to apply academia to development, and stands out for having built its business around this approach. The fundamental make-up of IOHK’s products is based on academic research, mostly peer-reviewed and undertaken by some of the most prominent figures in the field. Instead of just making something and hoping it works and is secure, IOHK goes through a painstaking process of making sure that the code which underpins our products is in line with the mathematically proven and verified findings of research.

IOHK is working on a number of projects, including Cardano, the first blockchain to be built on scientific principles that have been tested by academic teams; Daedalus, a cryptocurrency wallet; Plutus, a functional programming language designed for blockchain; and Marlowe, an easy-access programming language for creating smart contracts for those with a non-technical background. IOHK also collaborates with organizations across the world to run educational schemes, training the next generation of blockchain developers from Scotland, Japan, Greece, and elsewhere.

Originally published at https://www.amazix.com.

By AmaZix Editorial on May 14, 2019.

Exported from Medium on January 30, 2020.